As tax authorities continue to work toward modernizing VAT Compliance and Reporting, they identify new tools and techniques that help them understand what’s happening in a business and if it is compliant with VAT and other governmental regulations. One such tool is the Standard Audit File for Tax or SAF-T. The SAF-T comes out of a set of OECD standards, and the hope was it would contain details from the general ledger and the VAT Returns in a standard way for taxpayers to report worldwide. Unfortunately, the only thing that’s standard SAF-T is its name; many countries have adopted different formats and added their internal requirements making it a more complicated replacement of a VAT Return.

What is Standard About the SAF-T

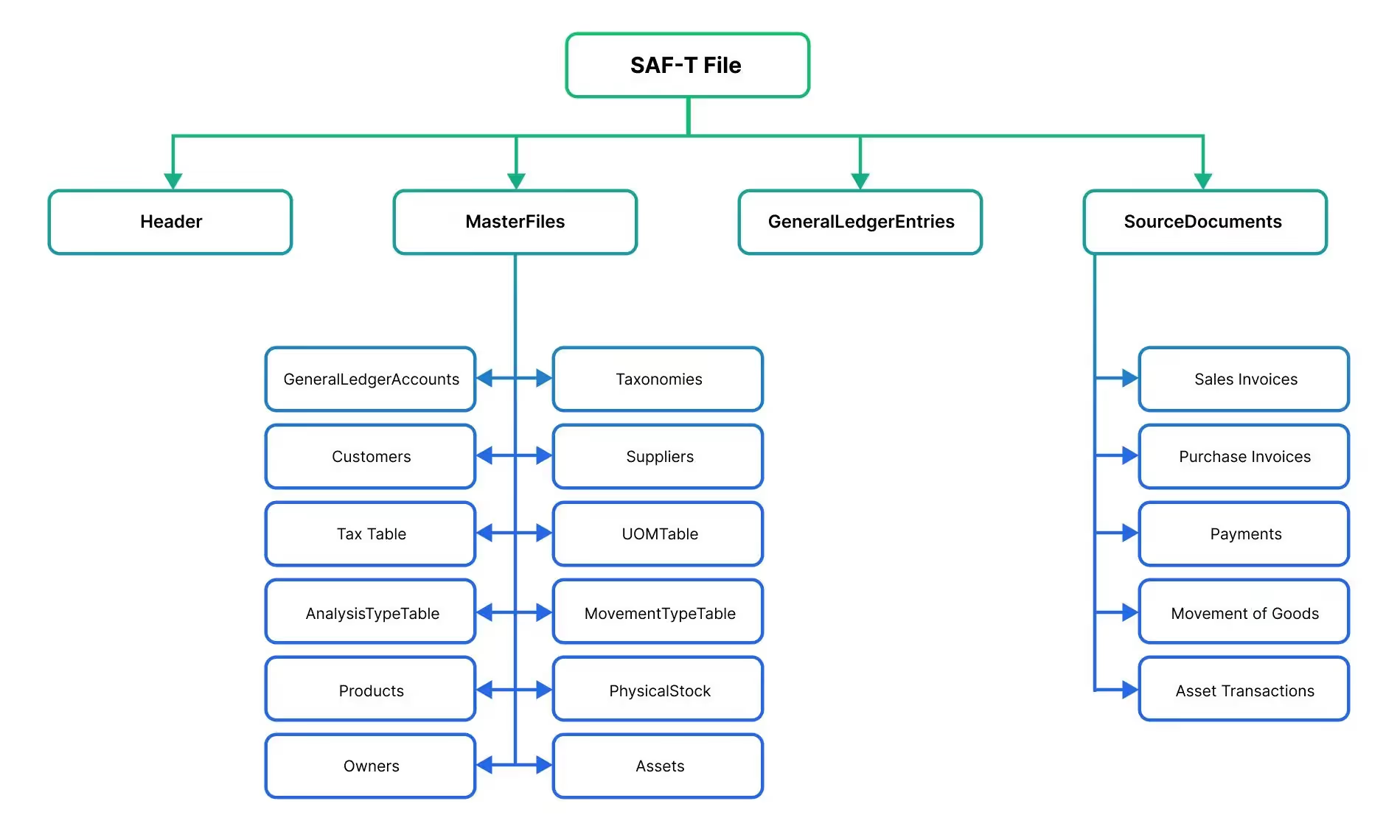

The general things that make the SAF-T standard are what it contains and how it contains the information. The SAF-T format is generally a machine format such as XML or XBLR, but no particular format is specified in the standard. The files (typically in the XML Format or XBLR format) are designed to easily be processed by the tax administration digitally. The concept includes accounting data from the ERP, such as the chart of accounts, customer listing, accounts receivable, accounts payable, and general VAT data, all in a standardized schema. For a tax authority, this standardized data means they have everything that is needed to view tax at all levels and to understand more information about the functionality and financials of the business and if the business is paying its taxes accurately.

As it is a standard format and goes through an electronic exchange (usually through a direct API or as an upload on the tax authorities’ website), the tax authority can easily run validation and sanity checks making non-compliant companies more visible, and enforcement more focused and easier. By integrating the bookkeeping and accounting information into the SAF-T file, the tax administration can better view the taxpayers' business at a more frequent level (nearly real-time) rather than an on-demand level. That is preferable to waiting for audits and receiving responses to requests.

A Short History of the SAF-T

The OECD created the SAF-T to make a standard and accessible file format that tax administrations and countries could use to handle routine compliance tasks with taxpayers, such as tax returns and tax compliance. The SAF-T set out an international standard, which is being more commonly used in European countries for tax compliance. The standard has two versions, a V1 (2005) and V2 (2010), designed to be a cross-border standard. However, the standard allows tax administrations to add their own country-specific elements. Some European countries have adopted the V1 and others have adopted the V2 standard, which creates a challenge as they are not 100% backwards compatible. For example, Portugal and Austria adopted the V1 standard, but Poland has adopted V2. This ultimately means the file output is incompatible due to the standard and country-specific requirements. The requirements for the format are standardized in terms of structure, but details like the file format are left up to the country, so some countries use XML, others use XBLR, and neither is fully compatible.

The structure illustrated below shows the general structure of the SAF-T.

How SAF-T Gets Implemented

Countries like Romania, Norway and Poland have released the SAF-T to their taxpayers, replacing the VAT Reporting requirements with the SAF-T reporting. While the SAF-T requirements on business vary slightly between countries, they tend to follow similar guidelines.

As the SAF-T is implemented, it is often imposed on the large taxpayers first before being gradually rolled out over time to the medium and small taxpayers. This is how Romania is implementing it; they are now in the medium taxpayer stage and will eventually roll it out to all taxpayers.

The SAF-T Tax Table generally provides the same information as the VAT Return, except the descriptions are changed, and codes are used (they are also standardized). When countries like Poland add additional tax fields, they still contain a Tax Table but then add onto it with their needed information sets.

How can Fonoa help?

Fonoa offers best-in-class Returns software, which includes support for traditional VAT forms as well as complex forms like the SAF-T. With the fully automated approach, you can take your transactional data and complete the Tax Tables and transaction tables accurately and quickly. Fonoa has experts in the world of VAT compliance and offers a suite of tools that makes it easy to stay compliant with current and future tax regulations.

Contact us to learn more about SAF-T or indirect compliance worldwide.