Tax automation and compliance for software companies

Retain customers and expand into new markets with a single platform for fully compliant tax workflows.

Let's talkGlobal coverage, tailored to software companies

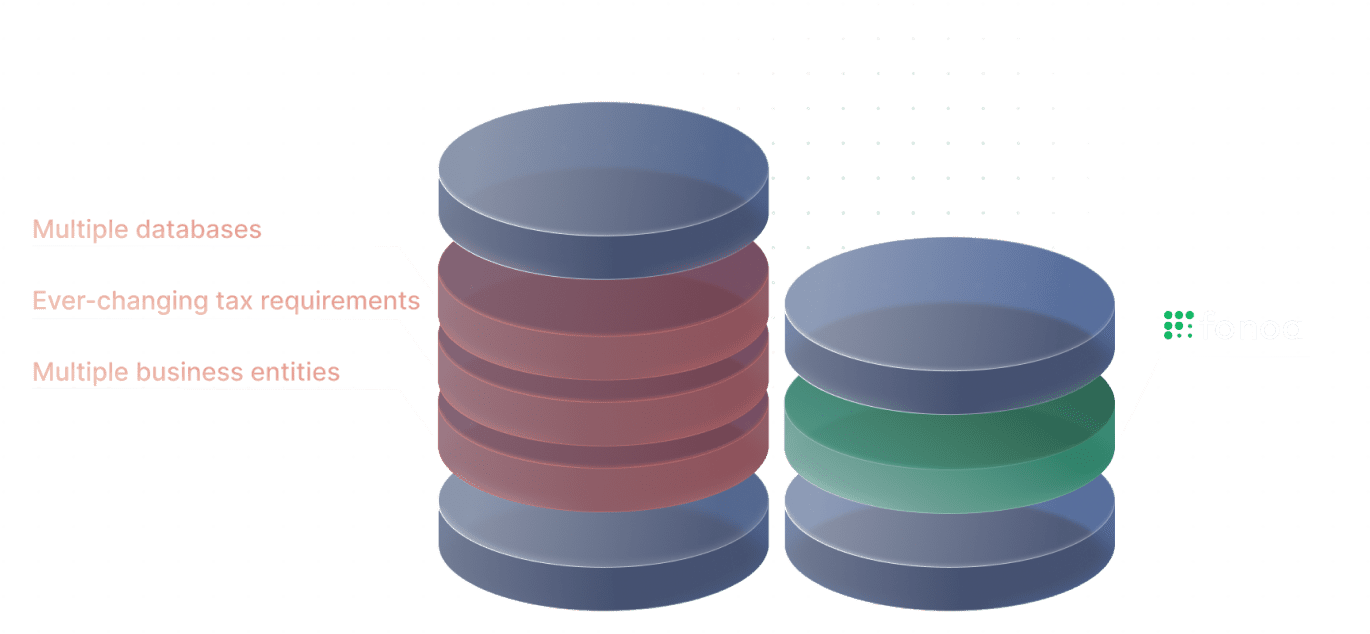

Software companies face increased tax compliance pressure around the world with the introduction of digital services and electronically supplied services rules. Cut through the complexity with a single solution and managed compliance services.

Global e-invoicing

Produce locally compliant invoices and e-invoices anywhere you need to.

Explore E-invoicing

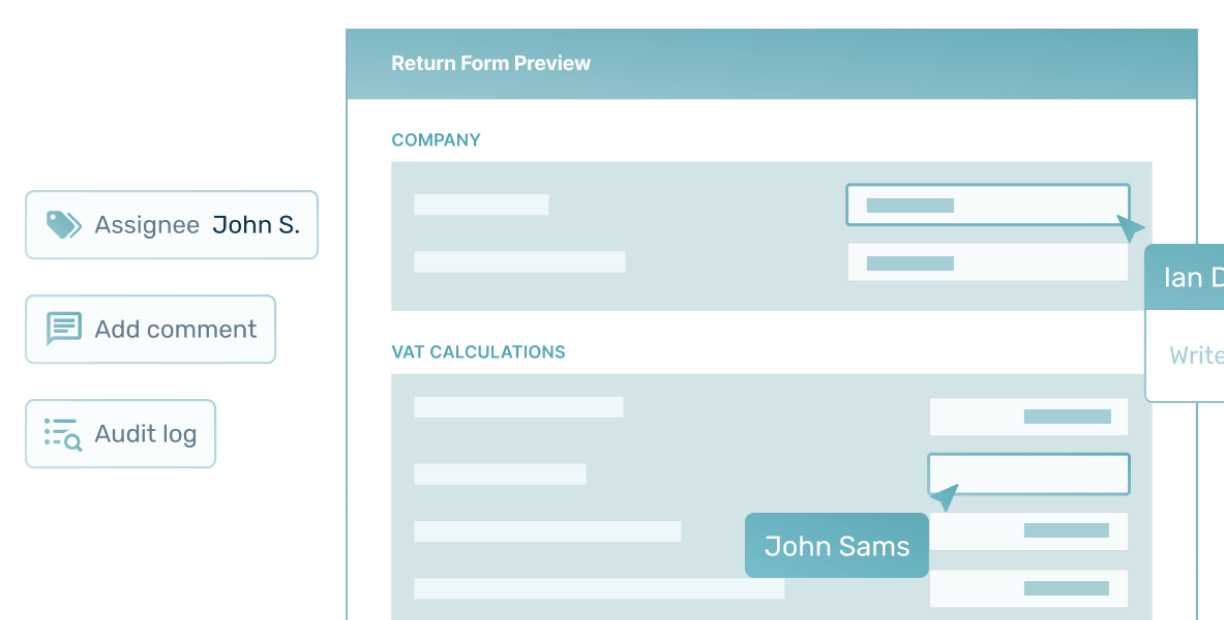

Next level tax return automation

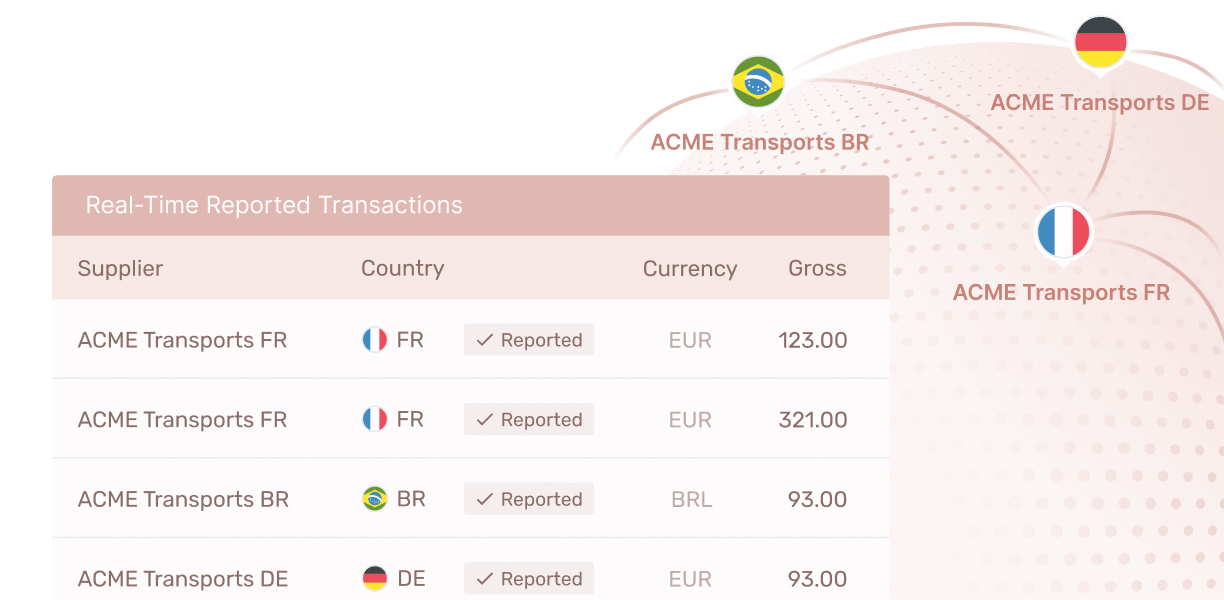

Automatically prepare and submit VAT/GST returns across the globe.

Explore Returns

Reduce risk as you grow

The stakes are high for software and digital services - each instance of non-compliance carries cost, accelerates churn, and even puts business in jeopardy of being shut down locally.

Fonoa is the first global tax automation platform that allows you to validate tax numbers, determine taxability, generate invoices and e-invoices, report transactions and file your tax returns through a single solution.

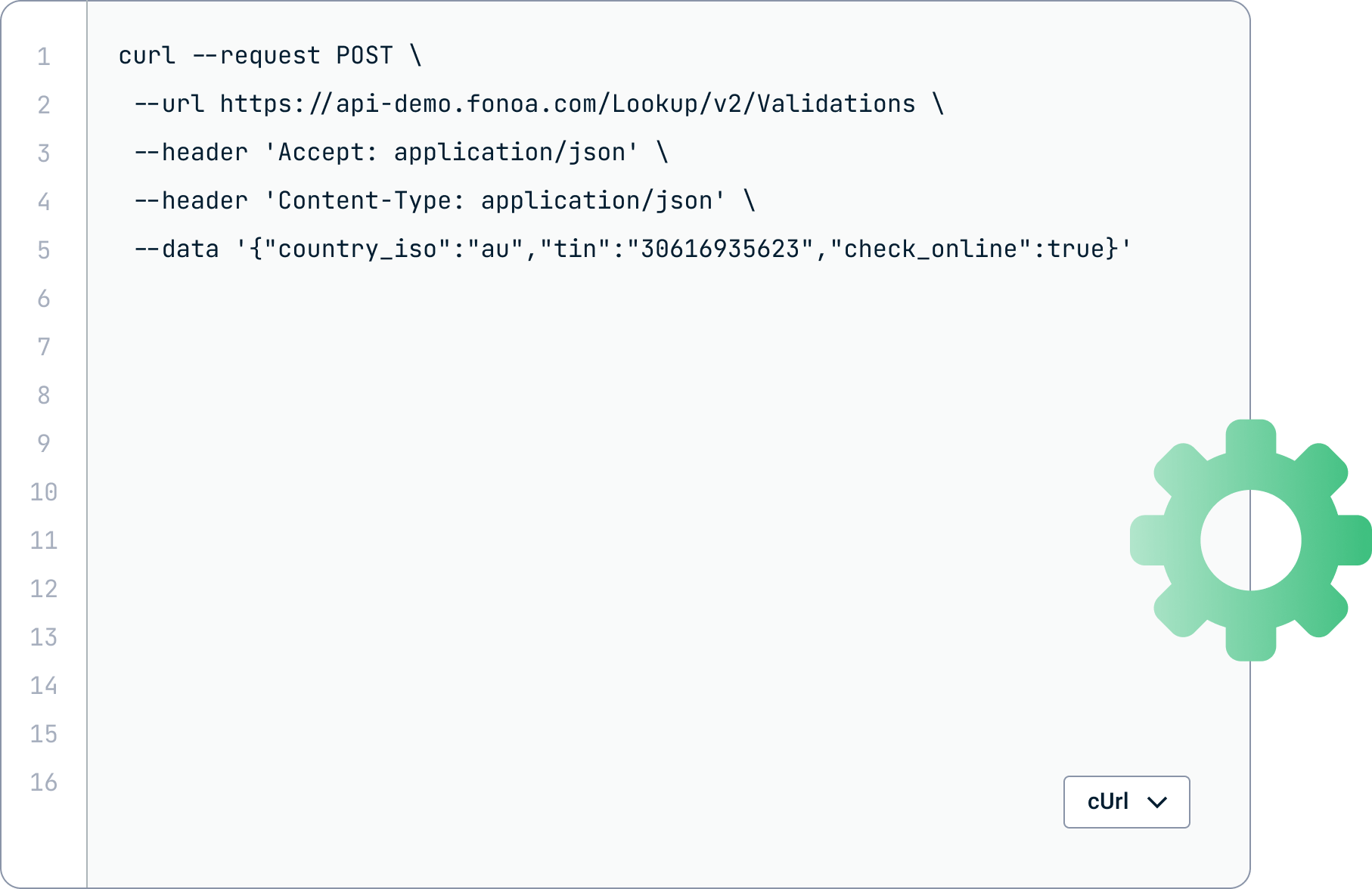

Move fast

with

painless integrations

Become compliant in any market in just a few days by integrating the Fonoa product suite into your workflows.

- Simple APIs for each product let you connect without significant engineering resources.

- Integrate with your API or ERP.

- Get enterprise-grade support throughout the process.