Global tax solutions for travel

Automate tax collection, data management, and compliance with a suite of products built for cross-border transactions.

Let's talkNavigate complex cross-border travel regulations

Travel operators often face additional and specific tax complexities. Fonoa’s platform is flexible to accommodate the most complex tax logic, invoicing needs and digital reporting requirements.

Charge the right tax to customers every time

Give customers and guests a flawless, friendly experience by charging them correctly for lodging, transportation, and services purchased online.

Explore Tax

Validate tax IDs of suppliers or guests

Validate customer and supplier tax IDs in 100+ countries through a simple user interface or API integration.

Explore Lookup

Keep your hospitality or travel marketplace compliant

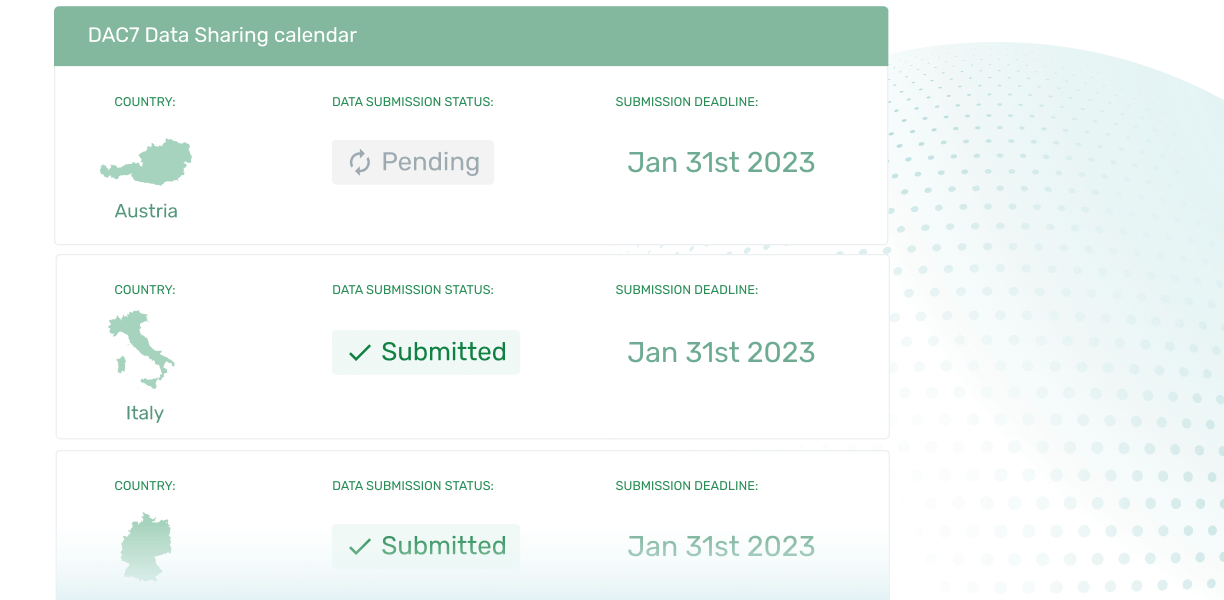

Determine tax obligations for you and your sellers, produce locally compliant invoices, and report transaction data in accordance with DAC7 — all with a single global tax solution.

Explore Data Sharing

Streamline and automate invoicing

Issue invoices in the right language and format automatically from a single platform, for your buyers and on behalf of your hospitality marketplace sellers.

Support for

- Receipts

- Self-billing

- Summary invoices

- Credit notes

- 3rd party billing

- Transportation documents