Global tax ID validation

Instantly validate tax IDs in 110+ countries to ensure compliance with local tax regulations

Get Started

Essential Guide to Tax ID Validation

Access GuideValidate thousands of tax IDs in minutes 100% automated

Watch the videoTrusted by the world’s leading companies

Why validate tax IDs?

Sharing Tax Data

Efficient tax data management for compliance

- DAC7

- EC Sales List

- Invoicing

- E-invoicing

- Tax Filings

Common pain points

Incorrect information shared with tax authorities

Audits and penalties from failing to adhere to tax regulations

Risk to damage business reputation

Errors and rejections in e-invoicing data

Solution

Enhanced Fraud Protection: Confirm suppliers are active and tax-registered

Minimized Noncompliance Risk: Share accurate tax info.

Less Troubleshooting: Save time with validated data.

Tax Calculation

Accurate tax calculation on all transactions to optimize margins

- Charging Tax

- Protecting AP

- Withholding Taxes

Common pain points

Liability for tax miscalculations

Negative impact on customer experience

Risk to input tax recovery

Uncertainty about suppliers' tax status

Paying fraudulent taxes

Solution

Avoid Tax Liabilities: Ensure accurate tax calculations and compliance.

Time Savings: Eliminate transaction and invoice corrections.

Improve customer experience: Prevent errors in tax.

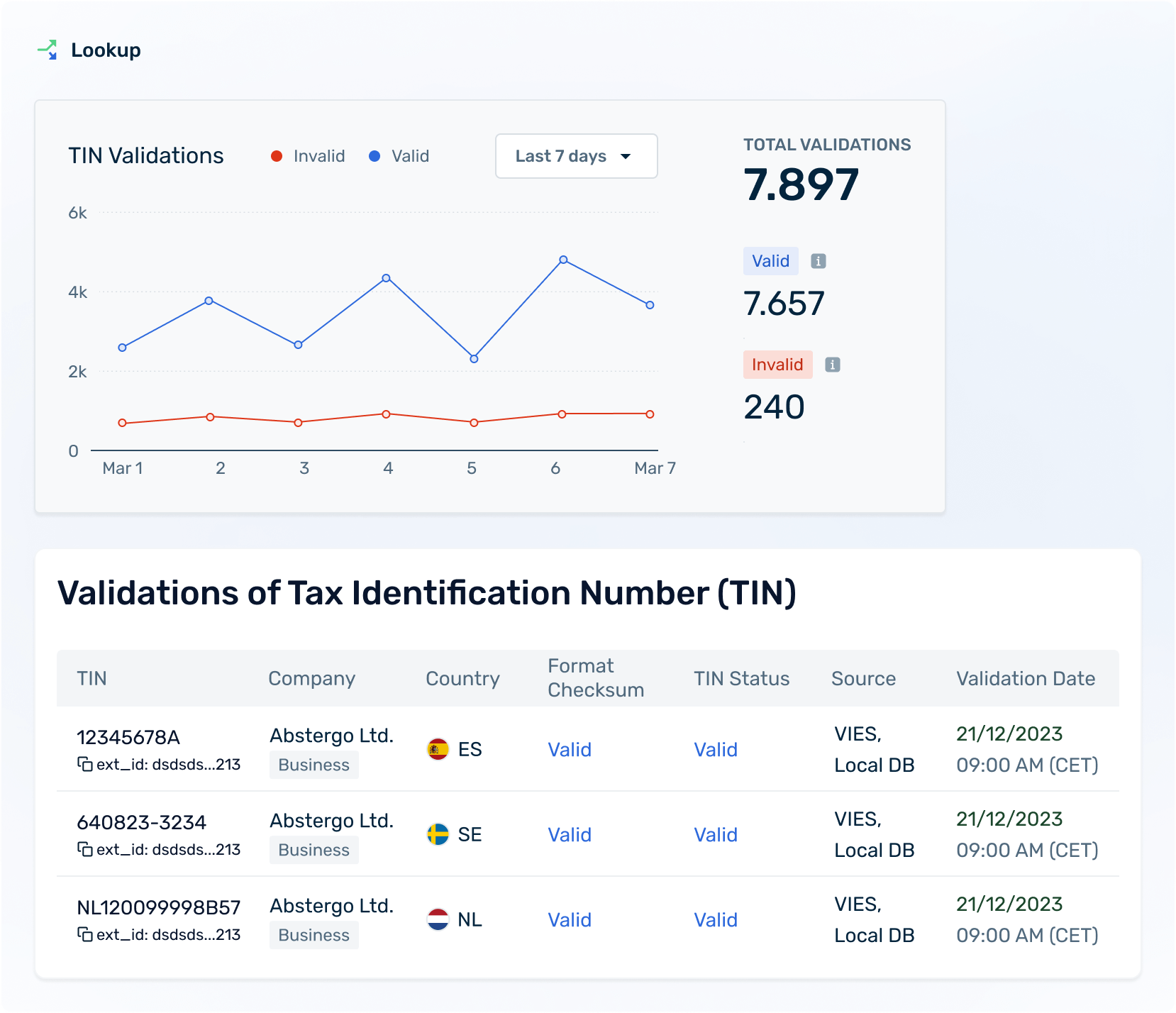

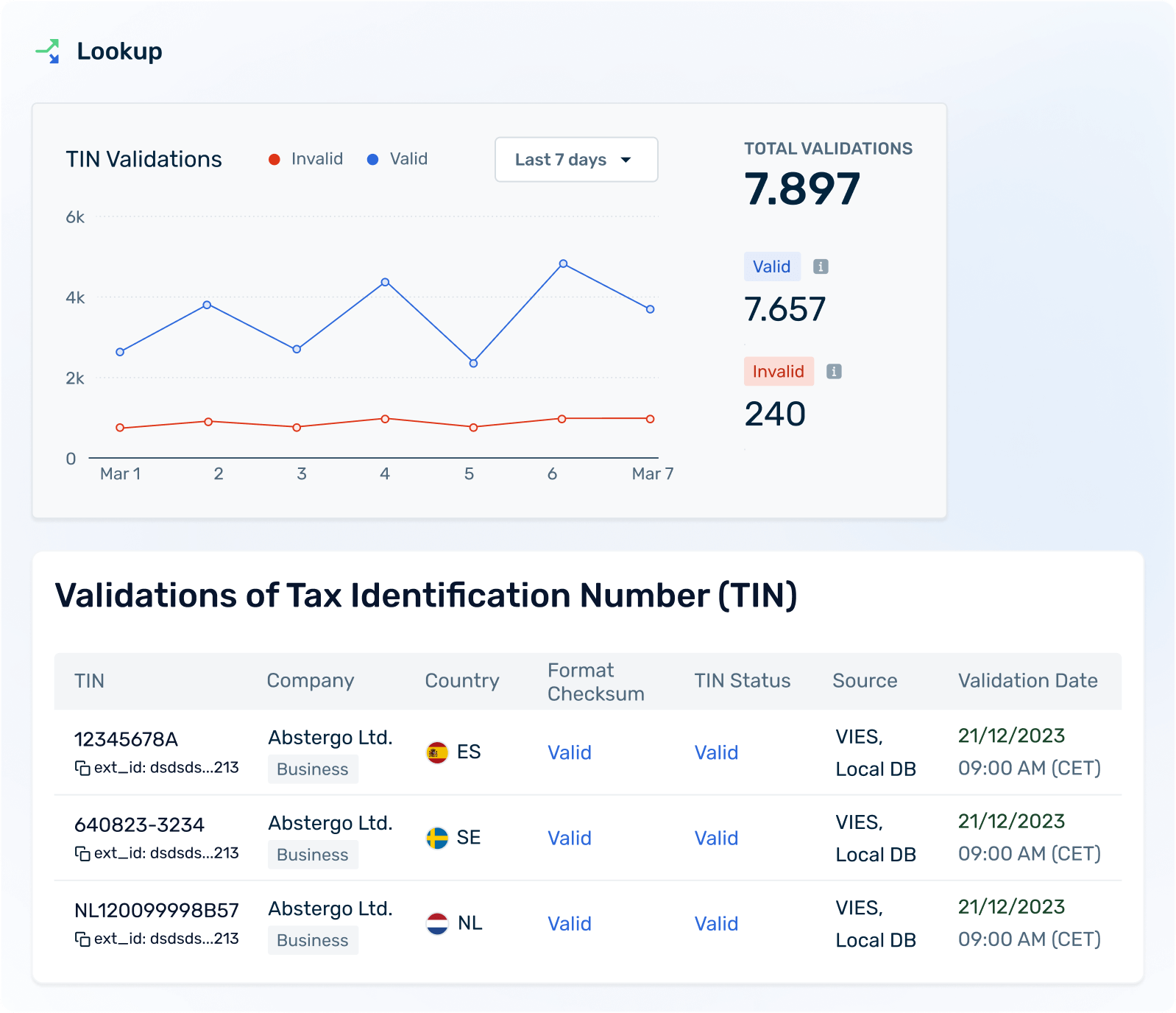

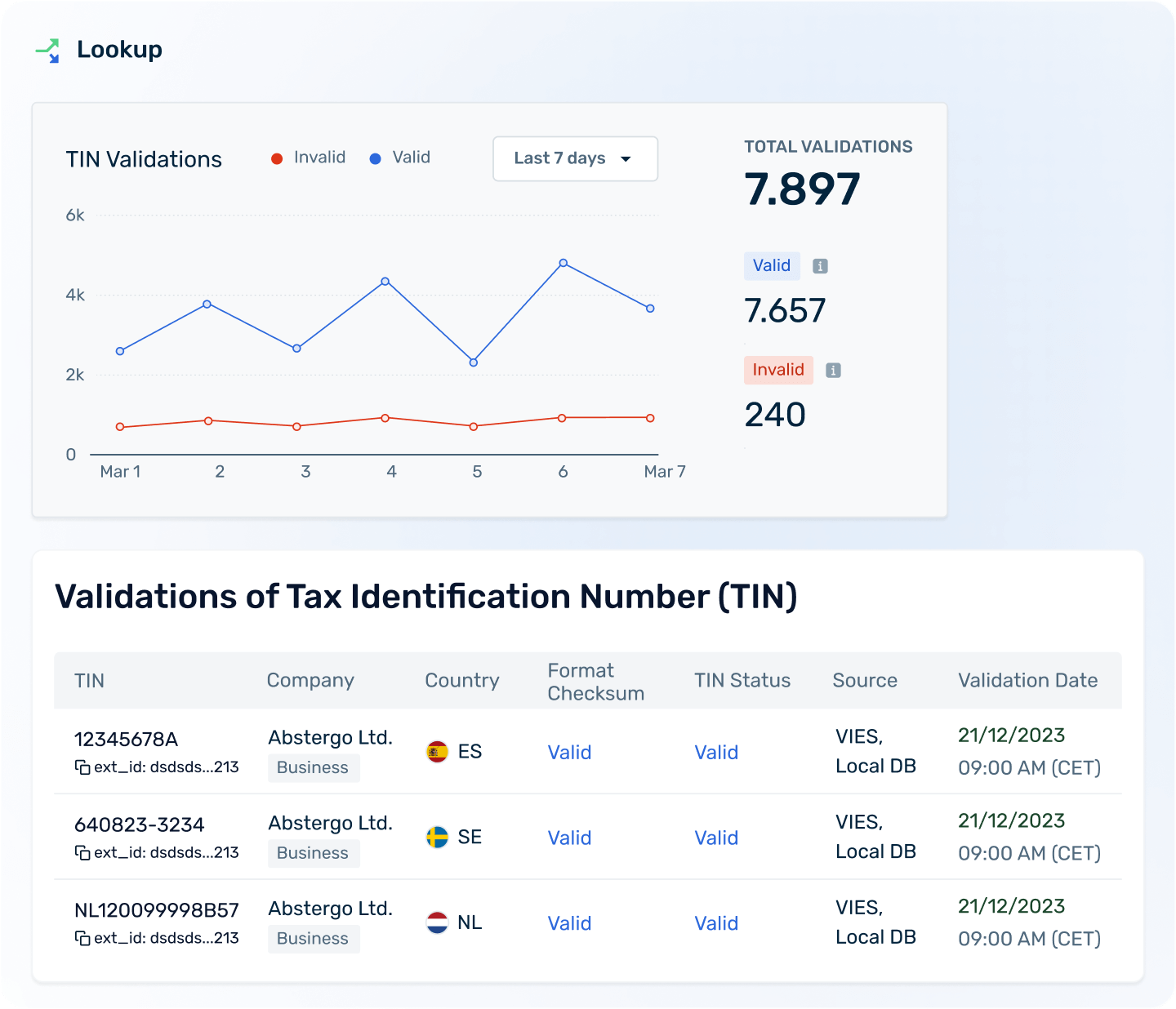

Most advanced solution in the industry

Most providers only verify tax ID formats or perform basic syntax checks, while some check VIES exclusively. Fonoa goes beyond, covering 110+ countries with direct access to local official databases. This ensures you receive the most up-to-date and comprehensive information, fast.

Real global coverage

Instantly validate tax IDs in 110+ countries.

Automatically clean your data

Rely on advanced auto-formatting to clean your data and save time solving for errors.

Search by name

Search by name and find tax IDs you are missing.

Process validations in bulk

Perform validations with up to 50,000 numbers in a single batch.

Comprehensive results

Retrieve the most comprehensive information related to tax IDs directly from government sources.

Simple access and flexible usability

Monitor and review validations from a simple, intuitive user interface, or integrate directly through our API.

What our customers are saying about our tax ID validation solution

Fonoa allows Uber to be able to validate taxpayer status both in VIES, and in the national databases across the EU, allowing us to have a complete picture over the taxpayer status of our supplier base.